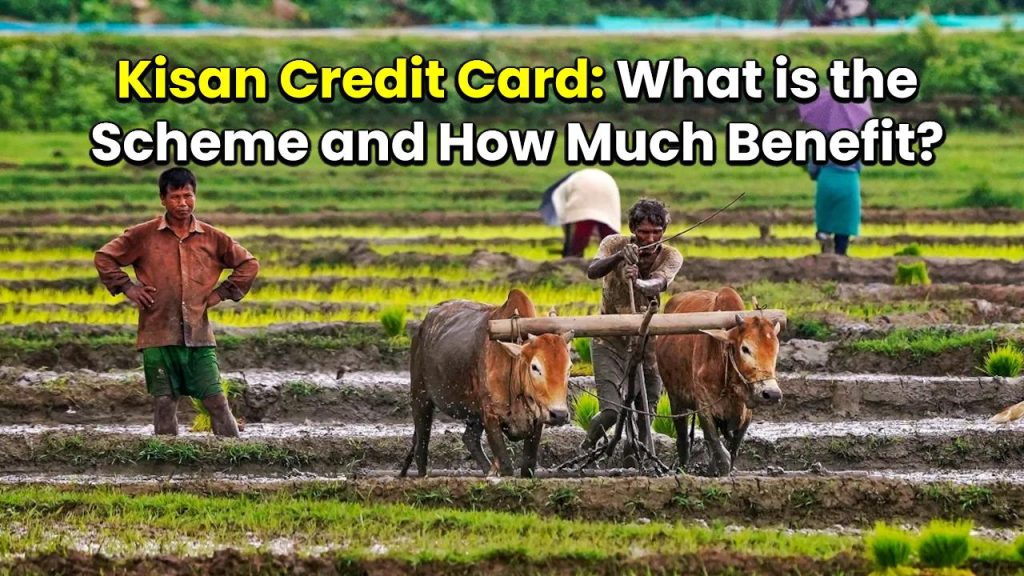

The Kisan Credit Card (KCC) scheme has emerged as a crucial financial tool for Indian farmers, providing them with easy access to institutional credit. As of December 2024, the total amount sanctioned under operative KCC accounts has surpassed ₹ 10 lakh crore, benefiting over 7.72 crore farmers across India. This milestone underscores the scheme’s effectiveness in empowering farmers with affordable credit solutions.

Whether you are a farmer looking to understand how KCC works, its benefits, eligibility, and how to apply, or a professional in the agriculture sector, this comprehensive guide will help you navigate through the scheme’s details.

Kisan Credit Card: What is the Scheme and How Much Benefit?

| Feature | Details |

|---|---|

| Total KCC Amount (2024) | ₹ 10 lakh crore+ |

| Number of Beneficiaries | 7.72 crore farmers |

| Interest Rate | 7% per annum (4% with prompt repayment) |

| Maximum Loan Without Collateral | Up to ₹ 2 lakh |

| Revised Loan Limit | Increased from ₹ 3 lakh to ₹ 5 lakh in 2025 |

The Kisan Credit Card scheme has been a game-changer for Indian farmers, providing them with timely and affordable credit. With the loan amount crossing ₹ 10 lakh crore, the scheme continues to empower farmers, reduce their dependence on informal lenders, and boost agricultural productivity.

For farmers looking to apply for a KCC, understanding eligibility, benefits, and application steps can help in securing financial assistance effortlessly.

What is the Kisan Credit Card (KCC) Scheme?

The Kisan Credit Card (KCC) scheme was launched by the Government of India in 1998 to provide timely and adequate credit support to farmers. The objective is to reduce farmers’ dependence on informal credit sources like moneylenders, who often charge exorbitant interest rates.

The KCC scheme covers multiple farming needs, including:

- Crop cultivation – Short-term credit for seeds, fertilizers, pesticides, and other inputs.

- Post-harvest expenses – Financial assistance after harvesting to avoid distress selling.

- Marketing loans – Credit support for storing and selling produce at a better price.

- Household expenses – Financial assistance for personal and emergency needs.

- Allied agricultural activities – Includes dairy, poultry, fisheries, and animal husbandry.

- Farm equipment & investments – Loans for purchasing tractors, irrigation systems, and other essential tools.

see also: Get Bumper Interest Returns on FD of 88 Days, Check the New Interest Rate

Who is Eligible for a Kisan Credit Card?

Farmers from different backgrounds can apply for a KCC. The eligibility criteria include:

- Individual farmers, owner cultivators, and tenant farmers.

- Sharecroppers, oral lessees, and tenant farmers.

- Self-Help Groups (SHGs) and Joint Liability Groups (JLGs) engaged in farming.

- Fishermen, dairy farmers, and animal husbandry farmers.

Benefits of the Kisan Credit Card Scheme

1. Low-Interest Loans

Farmers can avail of loans at an interest rate of 7% per annum. Additionally, a 3% prompt repayment incentive reduces the effective rate to 4% if the loan is repaid on time.

2. High Loan Limits

Initially, the maximum collateral-free loan limit was ₹ 3 lakh, but in the Union Budget 2025-26, it was increased to ₹ 5 lakh.

3. Flexible Repayment Schedule

Unlike traditional loans, the repayment cycle is aligned with harvest seasons, ensuring that farmers are not burdened with repayments when their income is low.

4. No Processing Fees for Small Loans

Loans up to ₹ 3 lakh are free from processing fees, reducing the financial burden on small and marginal farmers.

5. Overdraft Facility & Insurance Coverage

- KCC holders can avail an overdraft facility of up to ₹ 10,000.

- KCC-linked insurance provides financial protection against crop loss due to natural calamities.

How to Apply for a Kisan Credit Card?

Applying for a Kisan Credit Card is simple, and farmers can apply through banks, cooperative societies, or online portals. Here’s how:

Step 1: Choose Your Bank

KCC is offered by all major banks, including State Bank of India (SBI), Punjab National Bank (PNB), HDFC Bank, ICICI Bank, and NABARD-affiliated rural banks.

Step 2: Submit Required Documents

Farmers need to provide:

- Identity Proof – Aadhaar Card, PAN Card, or Voter ID.

- Address Proof – Utility bill, Ration Card, or Aadhaar.

- Land Ownership Proof – Record of rights or tenancy agreements.

- Bank Account Details – A linked bank account for disbursing the loan.

Step 3: Loan Sanction & Disbursement

Once verified, the bank approves the loan, and farmers receive a RuPay debit card, allowing them to withdraw money or purchase farm inputs directly.

Challenges & Government Initiatives to Improve KCC Access

Challenges Faced by Farmers

- Lack of Awareness – Many farmers are unaware of the benefits and procedures.

- Documentation Issues – Small farmers without land ownership struggle with paperwork.

- Slow Processing – In some cases, bank delays hinder timely credit availability.

Government’s Initiatives

- The government is simplifying the application process to enable digital KCC applications.

- Expansion of KCC coverage to include animal husbandry and fisheries.

- Interest subvention schemes to make KCC loans more affordable.

see also: Tax Savings Strategies for 2025-26

Kisan Credit Card: FAQs

1. Can I apply for a Kisan Credit Card online?

Yes, farmers can apply for a KCC through official bank websites or the MyScheme portal.

2. What is the repayment period for KCC loans?

Repayment tenure depends on the crop cycle and harvesting period, usually ranging from 6 months to 5 years.

3. Can tenant farmers apply for a KCC?

Yes, tenant farmers, sharecroppers, and oral lessees are eligible.

4. How much loan can I get without collateral?

Farmers can avail of a loan of up to ₹ 2 lakh without collateral.

5. Is there any insurance coverage with KCC?

Yes, KCC holders get crop insurance coverage under PMFBY (Pradhan Mantri Fasal Bima Yojana).